|

WORLD'S

FIRST LNG-READY (LARGE) CONTAINER SHIP NAMED - NOV 27 2014

The race is on in global maritime circles to be the “world’s first” in every aspect of environmental friendliness, particularly in regards to the incorporation of LNG as fuel onboard commercial ships.

There was yet another “world first” today in South Korea at the Hyundai Heavy Industries shipyard in Ulsan when United

Arab Shipping Company (UASC) named the first ever LNG-ready ultra large container vessel MV Sajir, the first vessel in UASC’s current 17-ship “eco-efficient” newbuilding program, comprising 17 of the world’s most eco-efficient vessels.

MV Sajir has a 15,000 TEU capacity, and it is classed by DNV

GL. According to the owner, preliminary calculations indicate an Energy Efficiency Design Index (EEDI) value that is close to 50% below the 2025 limit established by the IMO. MV Sajir will start operating on the Asia–North Europe route after delivery. Ten further A15 vessels and six 18,800 TEU (A18) box ships will be delivered from Hyundai Heavy Industries and Hyundai Samho Heavy Industries to UASC by mid-2016.

"At UASC, we see efficiency as a key competitive differentiator in an increasing competitive market,” said H.E. Salem Ali Al Zaabi, Chairman of UASC. “Whether it stems from improving vessel design through our newbuilding program, strategic partnerships or empowering our people onboard and ashore to deliver improvements, efficiency pervades every facet of our expansion plans. The Sajir perfectly embodies this ethos and, as the first of 17 vessels in our current newbuilding program, represents an important milestone in the evolution of UASC.”

Sajir takes its name from an area in Saudi Arabia that is known for its luscious landscape and

farming heritage.

“These highly efficient vessels help us significantly reduce the amount of fuel we consume per container,” said Jorn Hinge, President and CEO of UASC. “We operate one of the world’s youngest container vessel fleets and are committed to making it more environmentally sustainable. The A15 vessels go beyond what regulations require and set new standards in terms of efficient, safe and sustainable operations,” he remarked.

“By combining leading innovations in ship design, propulsion technology, energy management and container stowage, the UASC newbuildings set new standards in container shipping. We would like to thank our partners for mutually sharing their knowledge with our experts in order to develop some of the most efficient and safest vessels the industry has seen so far,” said Tor Svensen, Chief Executive Officer of DNV GL Maritime.

The CO2 output per TEU for this new vessel class will be 22% less than for a 13,500 TEU vessel delivered only two years ago. The environmental credentials of the A15 class are further highlighted by the fact that these vessels are designed and prepared for a quick and cost-efficient LNG retrofit at a later stage. This “LNG-ready” concept has been confirmed with an Approval in Principle from DNV GL as an industry first. The vessels will further receive DNV GL’s CLEAN class notation, which documents that the new generation ships comply with environmental regulations beyond today’s normal

IMO, flag and class standards. They will also be provided with an Inventory of Hazardous Materials, which is not yet a mandatory requirement, and they are one of the first to receive an Energy Efficiency Certificate with documented EEDI.

The A15 class vessels also deliver world-class standards of structural safety. The fatigue strength of the hull structure is based on the assumption of 25 years of operation in the North Atlantic, which is far beyond the normal standard. The A15 vessels will also be equipped with a DNV GL approved hull stress monitoring system that provides guidance to the crew on current stress level in the ship structure during operation.

JULY

22 2014 - CLASS NK LNG TECHNOLOGY SEMINARS

ClassNK held LNG-Fuelled Vessel Technologies seminars in Shanghai and Singapore on 22 July and 24, July 2014, respectively.

With the industry looking to adopt cleaner fuels to meet new environmental regulations as well as future economic growth , the demand for LNG as a fuel is rapidly increasing. ClassNK said it organized the seminars to provide the industry with the latest technical information on the use of LNG as a fuel and related technology.

In addition to ClassNK’s own LNG experts, specialists from the various sectors of the

Japanese maritime industry including shipbuilders, shipowners and marine equipment manufacturers presented on a range of LNG related topics at the seminars. Approximately 160 industry members attended the event in Shanghai, and approximately 180 in

Singapore, where Taira Narisawa, Regional Manager of

China, and Toshio Kurashiki, Regional Manager of South Asia and Oceania gave the opening remarks on behalf of ClassNK at each respective event.

Among the foremost experts at the seminars, Professor Koji Takasaki, Graduate School of Engineering Sciences, Kyushu University gave a presentation titled “Development of Natural Gas Fuelled Ships in the World”, followed by a presentation from NYK LINE’s General Manager of Fuel Group Yukio Matsukata on “NYK’s Challenges on LNG Fuel Project.”

The seminar also explored viable options for the use of LNG as a fuel with Tetsuji Yamada, Daihatsu

Diesel MFG. Co. Ltd presenting on the “Development of Four-Stroke Marine Dual Fuel Engine,” and Kei Tanaka from the Cooperative Association of Japan

Shipbuilders outlining a “Study of Small Scale LNG

Carrier/Bunkering Ship with DF Engine.” Takashi Unseki, Chief Engineer,

Mitsubishi Heavy Industries explored various LNG usage options in his presentation “Environmentally Friendly and Superior Solution with LNG as Fuel.”

This seminar was supported by Japanese maritime media company Kaiji Press Co., Ltd in Shanghai and Maritime and Port Authority of Singapore (MPA) in Singapore.

For more information contact:

ClassNK Practical R&D Promotion Division

TEL: +81-3-5226-2025

FAX: +81-3-5226-2019

E-mail: rx-sec@classnk.or.jp

New Orleans-based Harvey Gulf International Marine says it has broken ground on the United States’ first LNG bunkering facility located at their Port

Fourchon, Louisiana terminal. This marks the official kick off of Phase I of the $25 million LNG (Liquefied Natural Gas) fueling facility at “Slip B”. When operational later this year, the facility will be the first of its kind in the United States, capable of refueling the Harvey’s upcoming fleet of dual-fuel offshore supply vessels and over-the-road vehicles operating on LNG.

“Today’s milestone represents another significant step in the path for Harvey Gulf to establish itself as the nation’s leader in utilizing LNG as a marine fuel,” said CEO Shane Guidry.

Harvey Gulf is currently investing $350 million on the construction of dual-fuel OSVs to be operated in the U.S. Gulf of Mexico. The first of six new ships was recently launched at Gulf Coast Shipyard in Gulfport, Mississippi and is expected to be christened and pressed into service later this year. Running on cleaner-burning natural gas, the 302-foot OSVs will meet the stringent requirements of the ABS

“ENVIRO+, Green Passport” notation, making them the most environmentally friendly OSVs in Gulf of Mexico.

“The dual fuel vessels and our LNG facility further expand HGIM’s commitment to develop and utilize the safest, most environmentally-friendly vessels and fuel technology available today,” Guidry added.

MAY

15 2014 - USA

In his speech at the LNG Export & Export & Infrastructure Conference Federal Maritime Commissioner

William P Doyle gives insights on the consequences of the adoption of Liquefied Natural Gas (LNG) as a marine fuel in the United States. The text from the Federal Commission Newsroom is as follows:

"Good Afternoon:

I am a Commissioner with the U.S. Federal Maritime

Commission. The Federal Maritime Commission is an independent regulatory agency responsible for regulating the nation’s international ocean transportation for the benefit of exporters, importers, and the American consumer. I should emphasize that my thoughts and comments here are mine and mine alone – they do not reflect the position of the Commission, and they should not be construed to represent the positions of any of my fellow Commissioners.

Liquefied Natural Gas (LNG) as a marine fuel is taking hold in the United

States. The Obama Administration strongly supports LNG as a marine fuel and is investing in the utilization of the fuel on ocean going ships. The Obama Administration is also embracing LNG’s potential on vessels working on the inland waterways. There is an abundant supply of natural gas in America. Natural gas has some positive environmental benefits when compared to traditional marine fuels. Considering the economics, natural gas is a more cost effective fuel source than marine residual and distillate fuels. The maritime industry is in the process of developing, converting and constructing LNG powered vessels. Bunkering for LNG vessels is an important component that is being explored and examined.

This afternoon I will address these points.

On January 1, 2013, the

United States Senate confirmed President Barack Obama’s nomination of William P. Doyle of Pennsylvania to Commissioner of the Federal Maritime Commission. He was sworn in on January 10, 2013.

Commissioner Doyle served over a decade as an officer in the U.S. Merchant Marine, serving aboard numerous classes of vessels. Combined, Commissioner Doyle has over 20 years of experience in the transportation industry, including both the maritime and energy sectors. Throughout his career, he has held several senior executive positions in the industry.

U.S. Supporting LNG as a Marine Fuel

Yesterday, Totem Ocean Trailer Express (TOTE) President & CEO Anthony Chiarello was honored at the White House as a 2014 transportation industry "Champion of Change." He was chosen for his role in leading the U.S. maritime industry toward natural gas as fuel.

Under the Obama Administration, the United States Department of Transportation’s Maritime Administration is sponsoring a $1.4 million program for two projects supporting the increased use of alternative fuels and technology in the maritime industry.

The first project is a public-private partnership between the Maritime Administration and U.S.-flag carrier Horizon Lines for the conversion and monitoring of one of its vessels to operate on LNG fuel. The second project includes a study being conducted by the U.S. subsidiary of Det Norske Veritas Inc. (DNV) to analyze the issues and challenges associated with bunkering of LNG powered vessels.

With respect to the inland waterways, there is an ongoing Pittsburgh Marine Corridor Natural Gas Feasibility Assessment which is examining whether realistic opportunities exist for converting inland waterways vessels from diesel to natural gas propulsion. This Assessment is being conducted through collaboration between Life Cycle Engineering, 3 Rivers Clean Energy, Marshall University Rahall Transportation Institute, and the Shearer Group,

LLC.

Next, the Port of Pittsburgh is funding the assessment and requirements of potential fueling sites as well as a cost benefit analysis for the conversion of vessels to LNG. According to U.S. Army Corps of Engineers, Pittsburgh is the third busiest inland port in the United States. About 34 million tons of cargo move through the Port of Pittsburg each year. Approximately 45,000 jobs are dependent upon this inland waterway transportation system.

The U.S. Department of Energy and the U.S. Maritime Administration are involved in these projects along with the Pittsburgh Region Clean Cities non-profit organization, the Richard King Mellon Foundation, the Benedum Foundation, and other industry companies.

The Pittsburgh Region Clean Cities is the designated regional organization for all U.S. Department of Energy Clean Cities initiatives. Clean Fuels/Clean Rivers is an initiative to build a natural gas marine corridor that includes the Pittsburgh river systems.

Importantly, the private sector has expressed strong interest and there are ongoing discussions regarding a demonstration project to convert an existing towboat to LNG power.

Environmental Benefits of Natural Gas

The use of LNG reduces sulfur oxide (SOx) emissions by between 90% and 99%. SOx is the major contributor to acid deposition otherwise known as acid rain. This reduction in emissions brings SOx emissions within limits mandated by the Emission Control Areas designated by the IMO. Using LNG reduces nitrous oxide (NOx) emissions by approximately 90%. NOx is a major contributor to smog. Finally, LNG has a lower carbon content than traditional bunker fuels, giving off up to 25% less CO2 emissions.

Under MARPOL’s Annex VI, progressively more limits for NOx and SOx emissions are being placed on the global shipping industry over the next decade. Within U.S. waters, these requirements are implemented through the Act to Prevent Pollution from Ships (APPS). NOx emission limits are being imposed in a tiered approach, based on engine speed, while SOx is being limited primarily by regulating sulfur content in fuel.

Economic Benefits of LNG as a Marine Fuel

Based on the current forecasts, natural gas delivered for production of LNG in the U.S. is now more than 50% less expensive on an energy equivalent basis than marine residual fuel and marine distillate fuel. It is projected that this relative price advantage will continue, and even increase, through 2035. This has opened up an opportunity for significant annual fuel cost savings when converting marine vessels that use petroleum fuel to natural gas operation.

About 70% of domestic shipping relies on distillate fuel oil and the remaining 30% relies on residual fuel oil. By contrast, over 90% of international shipping is fueled by residual fuel oil. In comparison to distillate fuel, residual fuel is much more viscous – and is essentially a solid at room temperature. Residual fuel must be heated to keep it in liquid form for transport and storage as a marine fuel. Residual fuel also has significantly higher sulfur content than distillate fuel – 1% sulfur or more – and much higher heavy metal content. Residual fuel is less expensive than distillate fuel.

Examples of Projects in the United States Moving Forward on LNG as a Marine Fuel

In February, General Dynamics NASSCO shipyard in San Diego, California held a ceremony marking the first cut of steel for the construction of TOTE’s new Marlin Class container ship. It is expected to be the first LNG-powered containership in the world. TOTE expects to build two of these LNG powered vessels and homeport them in Jacksonville, Florida and operate them in the U.S. mainland to Puerto Rico trade. The new Marlin Class vessels will create a reduction of sulfur dioxide (SOx) emissions by 98 percent, particulate matter (PM) by 99 percent, nitrous oxide (NOx) and carbon dioxide (CO2) by 71 percent over TOTE’s ships currently operating in Puerto Rico.

TOTE intends to strategically locate LNG fueling stations that will be an integral part of its operations. To this end, in February, TOTE announced an agreement with Pivotal LNG and WesPac Midstream to provide LNG to the ships by developing a new LNG fueling facility in Jacksonville, Fla.

TOTE is also currently in the process of converting its two 839-foot, MAN-powered Orca-class Ro/Ro vessels to mostly LNG operation. These vessels operate in the Tacoma, Washington to Anchorage, Alaska trade. In 2012, the U.S. Coast Guard granted TOTE the waiver it needs to convert the vessels while they remain in service. TOTE said that its conversion program is the product of a public-private partnership among TOTE, the U.S. Environmental Protection Agency, and the U.S. Coast Guard. TOTE has selected Wärtsilä to supply the main engines, generators and integrated LNG storage and fuel gas handling systems for the conversion project.

In November 2013, Crowley announced it had executed agreements with shipbuilder VT Halter Marine Inc., of Pascagoula, Miss., to build two of the world’s first LNG-powered combination container – Roll-On/Roll-Off (ConRo) ships. The ships will operate in the United States mainland to Puerto Rico trade. The vessel design is the work product of Wärtsilä Ship Design in conjunction with Crowley subsidiary Jensen Maritime, a Seattle-based naval architecture and marine engineering firm.

Additionally, in September 2013, Aker Philadelphia Shipyard and Crowley announced a partnership to build up to eight (8) tankers. Citing the monumental shale related activity in the United States, the parties are securing their respective positions due to the increased demand for U.S.-built tankers. These tankers are designed to allow the ships to convert to LNG power.

In November 2013, Aker Philadelphia Shipyard announced it had been selected by Matson Navigation Company (Matson) to construct two 3,600 TEU containerships. The containerships will be utilized in Matson's service from the U.S. West Coast to Hawaii. The vessels will be built with dual fuel engines and will be ready for conversion to LNG propulsion.

General Dynamics NASSCO shipyard currently has contracts and options to construct seven (7) LNG conversion ready U.S.-Flag tankers. NASSCO has agreements with Seabulk Tankers and American

Petroleum Tankers (now Kinder Morgan Tankers).

At the beginning of 2014, Zeus Development Corporation identified approximately 42 vessels in North America that are under development or evaluation for conversion to LNG fuel.

LNG Bunkering in North America

LNG powered ships will need to refuel.

In February, the U.S. Coast Guard issued a notice seeking public comment on two draft policy letters regarding safety measures for LNG as a marine fuel. The first draft policy letter provides voluntary guidance for LNG fuel transfer operations on vessels using natural gas as a fuel and for the training of personnel. The second draft policy letter discusses voluntary guidance and existing regulations applicable to vessels and land based facilities conducting LNG marine fuel bunkering operations, and provides voluntary guidance on safety, security, and risk assessment measures for these operations.

In March, the American Bureau of Shipping (ABS) released a report entitled Bunkering of Liquefied Natural Gas-Fueled Marine Vessels in North America. The objective of the report is to provide guidance to potential owners and operators of gas-fueled vessels, as well as LNG bunkering vessels and facilities, to help them obtain regulatory approval for projects.

Last month, the West Coast Marine LNG Joint Industry Project Steering Committee in Canada issued a report stating that Vancouver is positioned to be North America's preferred LNG bunkering destination.

In February, Harvey Gulf International Marine broke ground for its $25 million LNG fueling facility at Port Fourchon, La. In January, Gulf Coast Shipyard Group (GCSG) launched the first of six Harvey Gulf International Marine Dual Fuel (LNG) Offshore Supply Vessels.

Last year, Texas-based Waller Marine announced it would build a small-scale LNG facility at the Port of Greater Baton Rouge, Louisiana, to fuel vessels.

I hope that I have presented you with some meaningful insight on LNG marine fuel projects and developments. This sector is new but growing-- and there appears to be many opportunities available for those looking to operate LNG fueled vessels and/or enter into the LNG bunkering and fueling sectors."

LNG

FUEL FORUM - MIAMI MARCH 2014 -

KEY

SPEAKERS

Gurinder Singh, Program Manager, ABS GLOBAL GAS SOLUTIONS

Gautam Puri, Vice President, Marketing & Business Development, ROLLS-ROYCE MARINE NORTH AMERICA

Ian Campbell, Senior Marine Safety Inspector, Marine Safety & Security, TRANSPORT CANADA

Timothy Meyers, Design & Engineering Standards, Systems Engineering Division, U.S. COAST GUARD

Margaret Kaigh Doyle, Chair, US COAST GUARD CHEMICAL TRANSPORTATION & LNG ADVISORY COMMITTEE

Oskar Levander, VP Innovation, Engineering & Technology – Marine, ROLLS ROYCE

Aziz Bamik, General Manager, GTT

Jerry West, Power Products – Marketing & Distributor Support, ELECTRO - MOTIVE DIESEL

Bjorn Munko, Sales Manager, TGE MARINE GAS ENGINEERING

Sean Caughlan, Senior Associate, Marine Engineer, THE GLOSTEN ASSOCIATES

Tony Teo, Technology & Business Director, DNV GL

Roy Bleiberg, Director, ABS GAS SOLUTIONS

James C. DeSimone, Deputy Commissioner & COO, Ferry Division, New York City Department of Transportation, STATEN ISLAND FERRIES

Peter Keller, Executive Vice President, TOTE INC

Chad Verret, Senior Vice President, Alaska & Deepwater Operations, HARVEY GULF INTERNATIONAL MARINE, LLC

Johan Lillieskold, Business Development Manager LNG, MANN TEK AB

Jonas Akermark, Business Development Manager Scandinavia & Baltic, BOMIN LINDE LNG

John Hicks, Vice President, Global Passenger Ships and Americas Business Development, LLOYD'S REGISTER MARINE

Clay Riding, Director, Natural Gas Resources, PUGET SOUND ENERGY

Gary Van Tassel, Senior Vice President, LNG Technical, ARGENT MARINE MANAGEMENT

David Vincent, Project Leader, GAZ MÉTRO

Eddie Green, General Manager, North America Marine LNG Development, SHELL

Senior Representative, GDF SUEZ Gas North America

HIGHLIGHTS FOR 2014

Shipowners’ feedback – Staten Island Ferries and Harvey Gulf revealed the reality of converting to marine LNG. Delegates gained current insight from the passenger ferry and OSV operator’s perspective on meeting North American ECA requirements.

Shell insight & LNG availability update – Latest updates on LNG supply on major infrastructure projects in the US and Canada to create availability of LNG as a bunker fuel.

U.S. Coast Guard & Transport Canada regulations - Updates from key regulators on regional and international LNG bunkering guidelines, safety implications of your design choices and how to maximise safety in operations

Training requirements for LNG competent crew –Delegates learnt lessons from crew training provided for the LNG fuelled Harvey Gulf vessels. An opportunity to understand the new challenges crew will have to be prepared to face.

Viking Grace Fuelling Operational Case Study – Extended detailed sessions exploring the world’s first LNG fuelling vessel LNGF Seagas and the bunkering process of the world’s first LNG powered passenger vessel Viking Grace

Interactive LNG Design Workshop – Examined and overcame design challenges of LNG fuelled vessels. Assessed tank location, tank type, designing tugs and barges, safety of LNG transfer and the impact of LNG of a vessels’ payload.

Interactive Champagne Roundtable Discussions - Unique break-out forums for learning and networking in focused groups. Detailed discussion over Champagne on key topics including LNG design, regulation, crew training requirements or LNG availability

Marine LNG Technical Showcase – The latest LNG technology and technical solutions to improve safety, speed or efficiency of LNG bunkering operations.

Two Networking Drinks Receptions – Even more opportunities to mingle with fellow attendees and speakers in relaxed surroundings over a glass of wine. An early opportunity to meet and make contacts at the Welcome Drinks Reception and reflect on the day’s proceedings at the post-day one Networking Drinks Reception.

Interactive Delegate Poll– Felt the pulse of the industry with relevant on-the-spot questions and responses. Fantastic chance to see how fellow delegates and speakers view the next step in the world of marine LNG in North America

COMPANIES

IN ATTENDANCE

BG Group

Carnival Cruise Lines

Transport Canada

Royal Caribbean International

Norwegian Cruise Lines

Clean Energy

Eidesvik

Encana Oil & Gas

Moran Towing Corp

Rolls Royce

Excelerate Energy

Wärtsilä

ABS

NASSCO

Seacor Ocean Transport

DNV

Kirby Inland Marine

GTT

Shell

United States Coast Guard

Teekay Shipping

Seaspan Ferries

|

Shell

is a global group of energy and

petrochemicals companies with around 90,000

employees in more than 80 countries and

territories. We are the leading

international oil company in the LNG

industry and our capabilities span the full

LNG value chain. From floating LNG to

small-scale liquefaction, our innovative

approach ensures we are ready to help tackle

the challenges of the new energy future.

CO-SPONSOR

2014

The

Energy business of Rolls-Royce is a

world-leading supplier of aero-derived gas

turbine and reciprocating engine power and

gas compression packages for the world’s

energy industries. The business has a

substantial market presence in oil and

gas-related applications, and a growing

presence in land-based power generation

installations, including industrial,

commercial and municipal applications.

More than 15,000 units have been supplied to

customers in nearly 120 countries, and

approximately 50 per cent of the business’

sales are derived from aftermarket services.

SPONSORS

& EXHIBITOR 2014

ABS

is a leading international classification

society devoted to promoting the security of

life, property and the marine environment

through the development and verification of

standards for the design, construction and

operational maintenance of marine-related

facilities. The society has been at the

forefront of developing Rules and Guidance

for vessels operating in low temperatures.

ABS and the Russian Maritime Register of

Shipping (RS) have joined to develop

classification Rules for Arctic Liquefied

Natural Gas Carriers. To help address the

challenges of vessels operating in the

Arctic region, ABS has produced a Guide for

Vessels Operating in Low Temperature

Environments. Visit the ABS website at www.eagle.org.

Lloyd’s

Register is a leading provider of marine

classification services around the world,

helping ensure that internationally

recognised safety and environmental

standards are maintained at every stage of a

ship's life.

But

we are not just about surveying ships; we

are dedicated to helping our clients achieve

the best possible performance from their

fleets and operations. Lloyd’s Register is

at the forefront of supporting innovation in

gas technology. As well as leading

developments in gas-fuelled shipping, we are

helping make safe LNG bunkering possible,

assisting ports and port operators to

understand the steps involved in addressing

LNG bunkering risks.

MEDIA

PARTNERS 2014

LNG

OneWorld, a wholly owned subsidiary of

Drewry Shipping Consultants, is an

established brand within the LNG market

place. LNG OneWorld for over a decade has

been providing the industry professionals

with rich and in-depth coverage on the LNG

value chain helping them keep abreast of the

trends in the industry. It provides latest

news, editorials besides latest trade and

shipping data. With strength of over 8,000

registered members across the world. LNG

OneWorld contributes to help make better

trading and investment decisions. LNG

OneWorld’s subscriber base includes oil

& gas majors, shipowners, shipyards,

terminal operators, traders, risk managers,

analysts, and industry leaders. To be a part

of the LNG family and actively participate

in the live discussion forums on the latest

LNG issues all are welcome to register on www.lngoneworld.com

LNG

journal, the preferred magazine for the

industry's executives and engineers. It

tracks commercial developments such as

tenders, contracts, and new projects in

shipping and the construction and planning

of import and production plants. Trading,

pricing and product specification trends are

highlighted. Legal developments are tracked

in the fields of supply, shipping and

commercial finance contracts and insurance.

SUPPORTING

ASSOCIATIONS 2014

New

non-governmental organisation (NGO) to

promote safetyand industry best practice in

the use of LNG as a vessel fuel. SGMF

seeks to promote safe and responsible

operations for both LNG-fuelled

vessels and LNG bunker supply logistics.

SGMF seeks to promote best practice criteria

to all with responsibilities for, or an

interest in, the use of LNG as marine fuel.

SGMF was formed as a sister NGO to the

Society of International Gas Tanker and

Terminal Operators (SIGTTO). SGMF membership

is open to all stakeholders involved in the

LNG bunkering supply chain. SGMF members

will range from bunker suppliers, shipowners

and bunker barge operators to port

authorities and regulators

OFFICIAL

PUBLICATION

|

LNG

FORUM

CONTACTS

Maritime Customer Services

PO BOX 406 West Byfleet KT14 6WL UK

Tel: +44 (0) 20 7017 5510

Fax: +44 (0) 20 7017 4745

Email: maritimecustserv@informa.com

Paul Skinner - Sponsorship

Maple House, 149 Tottenham Court Road, London, W1T 7AD

Tel: +44 (0) 20 7017 4402

Email: paul.skinner@informa.com

Kathryn Barnard - Speaking opportunities

Tel: +44 (0)20 7017 6749

Email: kathryn.barnard@informa.com

Stephen

Newey - Exhibiting & General information

+44

(0)20 7551 9779

stephen.newey@informa.com

ABOUT

LNG

A natural gas vehicle or NGV is an alternative fuel vehicle that uses compressed natural gas

(CNG) or liquefied natural gas (LNG) as a cleaner alternative to other fossil fuels. Natural gas vehicles should not be confused with vehicles powered by propane (LPG), which is a fuel with a fundamentally different composition. Worldwide, there were 14.8 million natural gas vehicles by 2011, led by Iran with 2.86 million, Pakistan (2.85 million), Argentina (2.07 million), Brazil (1.70 million), and

India (1.10 million). The Asia-Pacific region leads the world with 6.8 million

NGVs, followed by Latin America with 4.2 million vehicles. In the Latin American region almost 90% of NGVs have bi-fuel engines, allowing these vehicles to run on either gasoline or

CNG. In Pakistan, almost every vehicle converted to (or manufactured for) alternative fuel use typically retains the capability to run on ordinary gasoline.

As of 2009, the U.S. had a fleet of 114,270 compressed natural gas

(CNG) vehicles, mostly buses; 147,030 vehicles running on liquefied petroleum gas (LPG); and 3,176 vehicles liquefied natural gas (LNG). Other countries where natural gas-powered buses are popular include India, Australia, Argentina, and

Germany. In OECD countries there are around 500,000 CNG vehicles. Pakistan's market share of NGVs was 61.1% in 2010, follow by Armenia with 32%, and Bolivia with 20%. The number of NGV refueling stations has also increased, to 18,202 worldwide as of 2010, up 10.2% from the previous year.

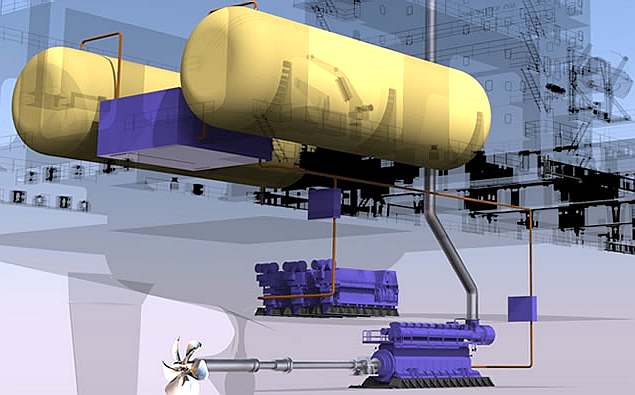

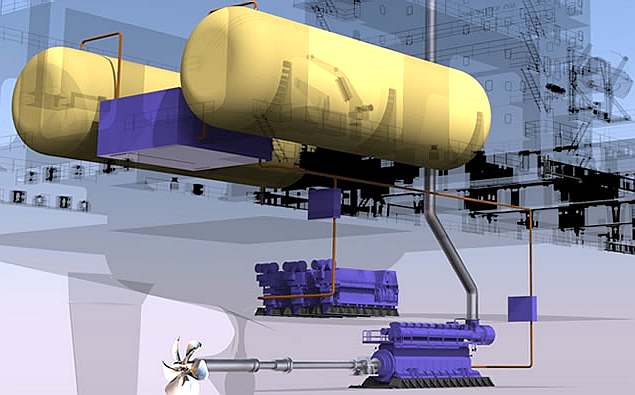

This

is a typical LNG fuel tank installation for large ships.

Shipping Insight 2014 is an event

in the US that looks at the issues of LNG bunkering and supply.

Letting

off steam. A couple of Smoky-Joes. Multiply these pictures by 100,000 and

you begin to see the scale of the problem.

OPEC

ENERGY SUBSIDIES - MAY 18 2014

Fossil fuel subsidies cost governments in emerging markets more than $500 billion every year and are a major contributor to climate change, according to the International Energy Agency (IEA) and International Monetary Fund (IMF).

The biggest subsidies are concentrated in the Middle East, North Africa, Asia and parts of Latin America, according to the IEA's Fossil Fuel Subsidy Database

(http://www.iea.org/subsidy/index.html).

Moreover energy-exporting countries accounted for three quarters of all consumption subsidies in 2012, according to the IEA and OPEC members account for more than half the world's subsidies.

Subsidies account for 82 percent of the cost of electricity and fuel in Venezuela, 80 percent in Libya, 79 percent in Saudi Arabia, 74 percent in Iran, and 56 percent in Iraq and Algeria. By contrast, the average rate of subsidy is just 18 percent in India and 3 percent in China.

In cash terms the world's biggest subsidies are in Iran, Saudi Arabia and Russia, all of which are major oil producers. Subsidies cost these three countries a combined total of $180 billion per year in 2012.

RATIONAL PRICING

In September 2009, the leaders of the world's largest economies meeting at the G20 summit in Pittsburgh committed themselves to phase out inefficient fossil fuel subsidies over the medium term.

According to the IEA, phasing out subsidies for oil, gas and electricity and aligning prices with international benchmarks would cut growth in energy demand by 5 percent and carbon dioxide emissions by 2 billion tonnes a year by 2020 - equivalent to the current combined emissions of Germany, France and the UK.

Raising gasoline, diesel and kerosene tariffs to market levels would save 4.7 million barrels of oil a day by the end of the decade ("World Energy Outlook 2011").

Cutting subsidies would also dramatically improve government budgets. Of 58 countries which subsidised gasoline, diesel or kerosene in 2010, 46 were running budget deficits, and in 27 cases the deficit amounted to more than 3 percent of GDP, the IMF explained in a staff note highly critical of the burden on taxpayers.

Halving subsidies would have reduced the average deficit from 2.1 percent of GDP to just 0.8 percent

("Petroleum product subsidies: cost, inequitable and rising" Feb 2010).

Subsidies often crowd out spending on infrastructure, development and social welfare. Indonesia spends more on fuel subsidies than on education or healthcare.

Venezuela sells gasoline for just 6 U.S. cents per gallon. The cost in lost export revenues is $30 billion, more than the combined value of all state spending on social programmes, Jim Krane at Rice University explained in a briefing paper published this month ("Navigating the perils of energy subsidy reform" May 2014).

WASTE AND HARM

Governments justify subsidies on the grounds that they alleviate poverty and promote economic development, but neither claim is really true.

Most of the benefits accrue to the middle class rather than poor because middle class families have more electrical appliances and their own cars.

In Indonesia, for example, the top 40 percent of high-income families absorb 70 percent of subsidies, while the bottom 40 percent of low-income families receive only 15 percent of the benefits ("The scope of fossil fuel subsidies in 2009" Nov 2010).

Subsidies also promote wasteful consumption. Saudi Arabia's artificially cheap gasoline and electricity have made the country one of the highest per-capita

energy users in the world and threaten to restrict the amount of oil left for export.

Another problem is fuel adulteration. Most countries subsidise kerosene used in cooking and lighting more heavily than gasoline and diesel used to fuel vehicles. But the resulting price gap encourages the illegal blending of kerosene into the diesel supply. Policies aimed at providing cheap cooking fuel for the poor end up helping middle class families drive motor cars.

And subsidies promote smuggling. Diesel sells for as little as 12 U.S. cents per litre in Iran compared with $1.20 per litre across the border in Pakistan. As a result the IEA estimates 60,000 barrels of diesel are smuggled out of Iran to Pakistan

and Afghanistan every day.

To combat smuggling into Yemen and other neighbouring states Saudi Arabia

inspects vehicles crossing its borders to ensure they only have enough fuel in the tank to reach the nearest refuelling station on the other side ("World Energy Outlook2013").

SOCIAL COMPACT

The theoretical case for reducing or eliminating subsidies is overwhelming, but in practice progress has been slow.

The fact that subsidies are concentrated in exporting countries and typically benefit middle-income and lower middle-income groups is no accident. Subsidies have a political dimension that makes them especially hard to reform.

Cheap electricity and fuel is often an important part of the social compact between governments and the population. "In major energy-producing countries consumption subsidies that artificially lower energy prices are seen as a means of sharing the value of indigenous natural resources," the IEA explains.

More bluntly, Rice University's Jim Krane observes: "Fossil fuel subsidies have allowed energy exporting countries to distribute resource revenue, bolstering legitimacy for governments, many of which are not democratically elected."

Even in energy-importing countries, like Indonesia and Pakistan, subsidised electricity and kerosene is a vital way for politicians to buy support from the urban middle and lower-middle classes - the groups most likely to form the core of protest movements.

CCC

CHALLENGER - This is a draft design for the 'Climate Change Challenger,' a zero

carbon ship concept that may be up scaled to larger cargo

and cruise

vessels. If the concept is proven, it could provide a way for the IMO to reach

their zero carbon objectives for 2050 and 2100.

REFORM EFFORTS

Policymakers in most countries acknowledge the need to reduce or remove subsidies, and the approach has strong backing from the

World

Bank, IMF and IEA. But efforts to reduce subsidies have met with limited success.

Iran, Indonesia, Ghana, Kenya, the Philippines, Mozambique and several other countries have all pushed through substantial price increases over the last two decades.

In other cases, however, price rises have had to be rolled back following popular protests. And the fact that Iran and Indonesia remain among the world's biggest subsidisers points to how limited the reforms have been even there in the face of tough public opposition.

To succeed reform programmes need to be accompanied by a strong communications strategy which points out that most of the benefits from subsidies go to wealthy households who can afford to pay the full cost of

energy, and carefully targeted social measures to compensate the poorest households.

Timing is important. Reforms are more likely to be successful if the oil price is falling, when households are less likely to notice the removal of subsidies, than when energy costs are already rising. China and Indonesia both took advantage of lower oil prices in 2009 and 2010 to reduce support.

Even if it proves impossible to remove subsidies altogether, energy prices can be depoliticised by explicitly linking the retail cost of gasoline, diesel and kerosene to international benchmarks with fixed but adjustable formulas.

"Establishing an automatic pricing formula ... can help distance the government from pricing of energy and make it clearer that domestic price changes reflect changes in international prices which are outside the control of the government," according to the IMF ("Energy subsidy reform: lessons and implications" Jan 2013).

Even so, removing subsidies remains fiendishly difficult. "Many countries have successfully implemented reforms only to see subsidies reappear when international oil prices increase," the IMF laments. The temptation to reintroduce price controls to help

households with rising living costs is strong.

And in the biggest

petro-states, including Saudi Arabia, Iran, Iraq,

Russia,

Kuwait, Venezuela, Libya and Algeria there has been virtually no progress towards more sensible energy pricing.

The result is a prodigious waste of energy. The petro-states are among the world's biggest and fastest-growing oil consumers and some are now having to import natural gas for power generation to meet

electricity demand. And the greenhouse emissions are enormous.

It is all ultimately unsustainable. "The state itself is teaching people to waste resources," complains one Kuwaiti newspaper editor. But subsidy reform is probably impossible without meaningful

political and social

change.

LLOYDS

REGISTER & UNIVERSITY COLLEGE LONDON ENERGY INSTITUTE - MARCH 2014

Heavy fuel oil will remain the main fuel for deep sea shipping in year 2030 indicates new research from Lloyd’s Register and University College London’s Energy Institute. In a complex study involving many inter-related factors, ‘Global Marine Fuel Trends 2030’ (GMFT 2030) limits itself to the container ship, bulk carrier/general cargo and tanker (crude & chemical/products) sectors which represent about 70% of the shipping industry’s fuel demand.

Marine fuels considered - Ranged from liquid fuels used today (HFO, MDO/MGO) to their bio-alternatives (bio-diesel, straight vegetable oil) and from LNG and biogas to methanol and hydrogen (derived both from methane or wood biomass) were included in the study.

|

Mobil

|

Chevron

|

Esso

|

Shell

|

Texaco

|

|

.

|

.

|

.

|

.

|

.

|

|

Motorship

Fuel Oil

|

Intermediate

Bunker Fuel (BF*)

|

Bunker

Fuel Oil (BFO)

|

Marine

Fuel Oil (MFO*)

|

Interfuel

(IF*)

|

|

Light

Marine Fuel Oil (LMFO)

|

Intermediate

Bunker Fuel (BF*)

|

Intermediate

Fuel (IF*)

|

Marine

Fuel Oil (MFO*)

|

IF*

|

|

Marine

Diesel Oil (MDO)

|

Marine

Diesel Oil (MDO)

|

Marine

Diesel Oil (MDO)

|

Marine

Diesel Oil (MDF)

|

Marine

Diesel Oil (MDO)

|

|

Distillate

Marine Diesel Oil

|

Light

Diesel

|

Light

Diesel Oil (LDO)

|

Marine

Diesel Fuel or Gas Oil (MDF/GO)

|

Marine

Distillate

|

|

Marine

Gas Oil (MGO)

|

Gas

Oil (GO)

|

Marine

Gas Oil (MGO)

|

Gas

Oil (GO)

|

Gas

Oil (GO)

|

MERCHANT

SHIPPING (POLLUTION) ACT 2006

The Merchant Shipping (Pollution) Act 2006 (c 8) is an Act of the Parliament of the

United

Kingdom. It has three main purposes: to give effect to the Supplementary Fund Protocol 2003, to give effect to Annex IV of the

MARPOL Convention, and to amend section 178(1) of the Merchant Shipping Act 1995.

MARPOL

73/78

Marpol 73/78 is the International Convention for the Prevention of Pollution From Ships, 1973 as modified by the Protocol of 1978. ("Marpol" is short for marine pollution and 73/78 short for the years 1973 and 1978.)

Marpol 73/78 is one of the most important international marine environmental conventions. It was designed to minimize pollution of the seas, including dumping, oil and exhaust

pollution. Its stated object is to preserve the marine environment through the complete elimination of pollution by oil and other harmful substances and the minimization of accidental discharge of such substances.

The original MARPOL was signed on 17 February 1973, but did not come into force due to lack of ratifications. The current convention is a combination of 1973 Convention and the 1978 Protocol. It entered into force on 2 October 1983. As of May 2013, 152 states, representing 99.2 per cent of the world's shipping tonnage, are parties to the convention.

All ships flagged under countries that are signatories to MARPOL are subject to its requirements, regardless of where they sail and member nations are responsible for vessels registered under their respective nationalities.

ENVIRONMENTAL ISSUES

Emissions from bunker fuel burning in ships contribute to air pollution levels in many port cities, especially where the emissions from industry and road traffic have been controlled. The switch of auxiliary engines from heavy fuel oil to

diesel oil at berth can result in large emission reductions, especially for

SO2 and PM. CO2 emissions from

bunker fuels sold are not added to national GHG emissions. For small countries with large international ports, there is an important difference between the emissions in territorial waters and the total emissions of the fuel sold.

The environmental impact of shipping includes greenhouse gas emissions and oil pollution. Carbon dioxide emissions from shipping is estimated to be 4 to 5 percent of the global total, and estimated by the

International Maritime Organization (IMO) to rise by as much as 72 percent by 2020 if no action is taken.

The First Intersessional Meeting of the IMO Working Group on Greenhouse Gas Emissions from Ships took place in Oslo, Norway on 23–27 June 2008. It was tasked with developing the technical basis for the reduction mechanisms that may form part of a future IMO regime to control greenhouse gas emissions from international shipping, and a draft of the actual reduction mechanisms themselves, for further consideration by IMO’s Marine Environment Protection Committee (MEPC).

EXHAUST EMISSIONS

Exhaust emissions from ships are considered to be a significant source of air pollution, with 18 to 30 percent of all nitrogen oxide and 9 percent of sulphur oxide pollution. "By 2010, up to 40 percent of air pollution over land could come from ships." Sulfur in the air creates acid rain which damages crops and buildings. When inhaled the sulfur is known to cause respiratory problems and even increase the risk of a heart attack. According to Irene Blooming, a spokeswoman for the European environmental coalition Seas at Risk, the fuel used in oil tankers and container ships is high in sulfur and cheaper to buy compared to the fuel used for domestic land use. "A ship lets out around 50 times more sulfur than a lorry per metric tonne of cargo carried." Cities in the U.S. like Long Beach, Los Angeles, Houston, Galveston, and Pittsburgh see some of the heaviest shipping traffic in the nation and have left local officials desperately trying to clean up the air. Increasing trade between the U.S. and China is helping to increase the number of vessels navigating the Pacific and exacerbating many of the environmental problems. To maintain the level of growth China is experiencing, large amounts of grain are being shipped to China by the boat load. The number of voyages are expected to continue increasing.

3.5 to 4 percent of all climate change emissions are caused by shipping. Air pollution from cruise ships is generated by diesel engines that burn high sulfur content fuel oil, also known as bunker oil, producing sulfur dioxide, nitrogen oxide and particulate, in addition to carbon monoxide, carbon dioxide, and hydrocarbons. Diesel exhaust has been classified by EPA as a likely human carcinogen. EPA recognizes that these emissions from marine diesel engines contribute to ozone and carbon monoxide

non-attainment (i.e., failure to meet air quality standards), as well as adverse health effects associated with ambient concentrations of particulate matter and visibility, haze, acid deposition, and eutrophication and nitrification of water. EPA estimates that large marine diesel engines accounted for about 1.6 percent of mobile source nitrogen oxide emissions and 2.8 percent of mobile source particulate emissions in the United States in 2000. Contributions of marine diesel engines can be higher on a port-specific basis. Ultra-low sulfur diesel (ULSD) is a standard for defining diesel fuel with substantially lowered sulfur contents. As of 2006, almost all of the petroleum-based diesel fuel available in Europe and North America is of a ULSD type.

As one way to reduce the impact of greenhouse gas emissions from shipping, vetting agency RightShip has developed an online “GHG Emissions Rating” as a systematic way for the industry to compare a ship’s CO2 emissions to peer vessels of a similar size and type. Using higher rated ships can deliver significantly lower CO2 emissions across the voyage length.

One source of environmental pressures on maritime vessels recently has come from states and localities, as they assess the contribution of commercial marine vessels to regional air quality problems when ships are docked in port. For instance, large marine diesel engines are believed to contribute 7 percent of mobile source nitrogen oxide emissions in Baton Rouge/New Orleans. Ships can also have a significant impact in areas without large commercial ports: they contribute about 37 percent of total area nitrogen oxide emissions in the Santa Barbara area, and that percentage is expected to increase to 61 percent by 2015. Again, there is little cruise-industry specific data on this issue. They comprise only a small fraction of the world shipping fleet, but cruise ship emissions may exert significant impacts on a local scale in specific coastal areas that are visited repeatedly. Shipboard incinerators also burn large volumes of garbage, plastics, and other waste, producing ash that must be disposed of. Incinerators may release toxic emissions as well.

In 2005 MARPOL Annex VI came into force to combat this problem. As such cruise ships now employ cctv monitoring on the smoke stacks as well as recorded measuring via opacity meter with some also using clean burning gas turbines for electrical loads and propulsion in sensitive areas.

CMTI LNG REPORT/STUDY

CMTI claim to have examined the technical and economic feasibility of LNG Retrofit with the financial support from the Maritime Innovation-Impulse Projects (MIIP) of ‘Nederland Maritiem Land (NML)’. Bottlenecks and solutions have been identified. The information for this study is partly obtained from a number of interviews with stakeholders and a study of

Panteia/NEA.

ECONOMIC

FEASIBILITY

As yet, retrofitting inland vessels for natural gas as marine fuel is only profitable for the largest classes (135*14.2m, 5600t; 2barge, 4600t and 4barge, 9200t) according to the Panteia/NEA research. With the assumption of a cost reduction of 50% the class 110 * 11.4m, 2750t can be added to the list.

Large-scale LNG retrofit will only take place if the Government facilitates with incentives and/or stringent measures.

The estimated fuel cost for LNG is conservative. According to LNG fuel suppliers LNG will be about 25% lower in price than diesel.

The cost for LNG retrofit strongly depends on the outcome of the HAZID study that must be carried out together with Class: What needs to be customized for security reasons? The list of actions will give LNG retrofit a price tag. The individual HAZID generates extra costs and may cost

extra time.

MARITIME LEGISLATION

The IMO ‘Interim Guidelines on safety for natural gas-fuelled engine

installations in ships’ form the basis for applying LNG as fuel for propulsion.

These guidelines are voluntary.

The IMO ‘International Code for Safety for Ships using Gases or Other Low Flashpoint Fuels (IGF Code)’ is under construction. The IMO Maritime Safety Committee (MSC) has dedicated IMO-BLG to develop the IGF Code, advised by IMO-DE, -FP, -SLF en

-STW.

POWERTRAIN

The transient response of the gas engine is different from the diesel engine. The new gas engine or the converted diesel engine must be tuned to guarantee reliability and power at operating conditions with low fuel consumption and minimal emissions.

There are two types of engines for natural gas as fuel, namely the ‘lean-burn’ and the so-called

‘dual-fuel’ engines. Both engine types are available from several suppliers for both inland and sea-going vessels.

The above engine types can be connected directly to the drivetrain (gas/diesel-direct) with or without ‘Power take-off/Power take-in’ option for various auxiliaries or when extra power is

needed, e.g. for manoeuvring. Another lay out is with generator sets (gas/diesel-electric).

Applying gas engines in combination with electric drive is a promising concept. The engine management system ensures that the desired power is supplied by the generator sets switching engines on/off, and/or managing the engine speed. Redundancy is guaranteed.

Applying natural gas as marine fuel reduces the emissions of NOx by 80% to 95%, the CO2

emissions by 20% to 25%. Soot and sulphur emissions are almost zero and there are no

carcinogenic substances such as PAK’s, aldehydes and butadiene.

It is important to know that if pure unconsumed natural gas comes into the environment, the greenhouse effect will be 21 times higher. Some LNG engines generate so-called ‘methane slip’. The positive effect on CO2 emissions is thus partially offset.

CMTI RECOMMENDATIONS

‘Methane slip’ must absolutely be avoided. This may be arranged with after treatment.

Limit the HAZID approach as much as possible and using legislation instead of HAZID. The HAZID experiences can be transformed into legislation.

New calculations with the Panteia/NEA economic model should be performed with LNG fuel costs 25% lower than the diesel fuel price indicated by the LNG fuel suppliers.

ALTERNATIVE

ENERGY

A

return to sails using autonomous

management of sail booms has been proposed and investigated in several

designs, the object being to eliminate manual trimming. Wing sails have

been shown to work, but have never taken off. Though, recent proposals by

Japanese ship builders include large sails on deck, a variation of the Walker

wing-sail system. Rotary wings, or turbines

is another area of harvesting energy from nature that is in its infancy,

Solar power has been used to circumnavigate

the globe, but at relatively slow speeds. Wave

power is another area receiving renewed attention.

LINKS:

Marine

link news container lng ready worlds largest

ClassNK

press_release

Bunker

World ClassNK

hosts seminars on LNG as marine fuel

Marine

Link Class NK LNG seminars

http://www.iea.org

G

Captain

Harvey-Gulf-breaks-ground-on-nations-first-lng-bunkering-facility

http://www.iea.org/subsidy/index.html

http://www.marinelink.com/news/subsidies-wasteful-energy369301.aspx

http://www.fmc.gov/bureaus_offices/commissioner_doyle.aspx

http://www.maritimepropulsion.com/news/lng-marine-fuel-taking-hold-in-america

http://en.wikipedia.org/wiki/Natural_gas_vehicle

What-fuel-will-ocean-going-ships-be-burning-16-years-down-the-road

Kittiwake

bunker fuel testing analysis

MARPOL

Marine_fuel_management

Merchant_Shipping_(Pollution)_Act_2006

Fuel_oils

http://www.marinelink.com/news/container-lngready-worlds381524.aspx

http://gcaptain.com/harvey-gulf-breaks-ground-on-nations-first-lng-bunkering-facility/

http://www.classnk.or.jp/hp/en/hp_news.aspx?id=961&type=press_release&layout=8

http://www.bunkerworld.com/news/i130913/ClassNK-hosts-seminars-on-LNG-as-marine-fuel

http://www.marinelink.com/news/technologies-seminars373685.aspx

http://www.liquidminerals.com/fuels.htm

http://www.platts.com/commodity/oil

http://www.platts.com/Shipping/BunkerFuel

http://pejnews.com

http://www.assa-kz.com/en/services/Bunker/

http://www.wp-marine.co.uk/bunker_fuel.html

http://www.kittiwake.com/bunker-fuel-testing-analysis

http://en.wikipedia.org/wiki/MARPOL

http://en.wikipedia.org/wiki/Marine_fuel_management

http://en.wikipedia.org/wiki/Merchant_Shipping_(Pollution)_Act_2006

http://en.wikipedia.org/wiki/Fuel_oil

Commissioner_doyle

Forget

bunker fuel, electric ships are now possible that operate on nothing but energy

harvested directly from nature. The ZCC above is a 50 ton

vessel with a low frontal area and hyper efficient SWASH hull, as with the

proposed merchant ZZC

platforms. This version is upgraded to 40kW wind turbines. The total

energy harvesting capacity of this design is around 176kW (235hp), giving an Energy

Harvested to Displacement ratio (EH/D) of 3.52kW/ton (4.72hp/ton). Larger

versions of this format could be the emission free cargo ships of

the future. The hull is 50m (163ft) hull on the waterline, length OAL is

56M (183ft).

The

cost of diesel fuel to operate this ship continuously for a year is

approximately: .29gals/hp x 117 x 24 x 365 = $297,226.80 (£183,393.99) In

ten years that would be $2.97M (£1.83M). Fuel for thought! Imagine

this craft unmanned

and 250m long with drones

for air

strikes. Rule Britannia!

|